Q2 2024 Net-Zero Airline Ranking Results

We present the Q2 2024 results of the Net-Zero Airline Ranking–an industry-first initiative.

Despite growing concerns about climate change and the impact of flying on our environment, there is significant uncertainty in the public debate about whether airlines are genuinely investing in the innovations needed for a net-zero aviation future.

Even with the airline industry's commitment to the Paris Agreement via IATA's net-zero pledge in 2021, the question remains: Are airlines truly on track to achieve these critical goals?

To address this pressing issue, we developed the Net-Zero Airline Ranking. It assesses the commitment of the world’s 20 largest airline groups to achieving a net-zero aviation future.

It represents the first publicly shared, quantifiable effort to hold the airline industry accountable for measurable sustainability investments.

The Net-Zero Airline Ranking we have developed is not without its flaws (as we outline in our methodology deep dive). However, it offers an initial, comprehensive understanding of airlines’ net-zero commitments based on measurable facts.

Key Results

The Q2 2024 edition is the first iteration of the Net-Zero Airline Ranking, and it reveals a sobering reality:

- The Net-Zero Commitment Rates of all 20 airlines in our ranking fall below 70%, indicating a substantial gap in true, comprehensive commitment.

- Notably, 18 out of the 20 airlines analyzed score below 33% on a full-scale net-zero commitment strategy.

Despite the overall disappointing performance, two airlines stand out relative to their peers:

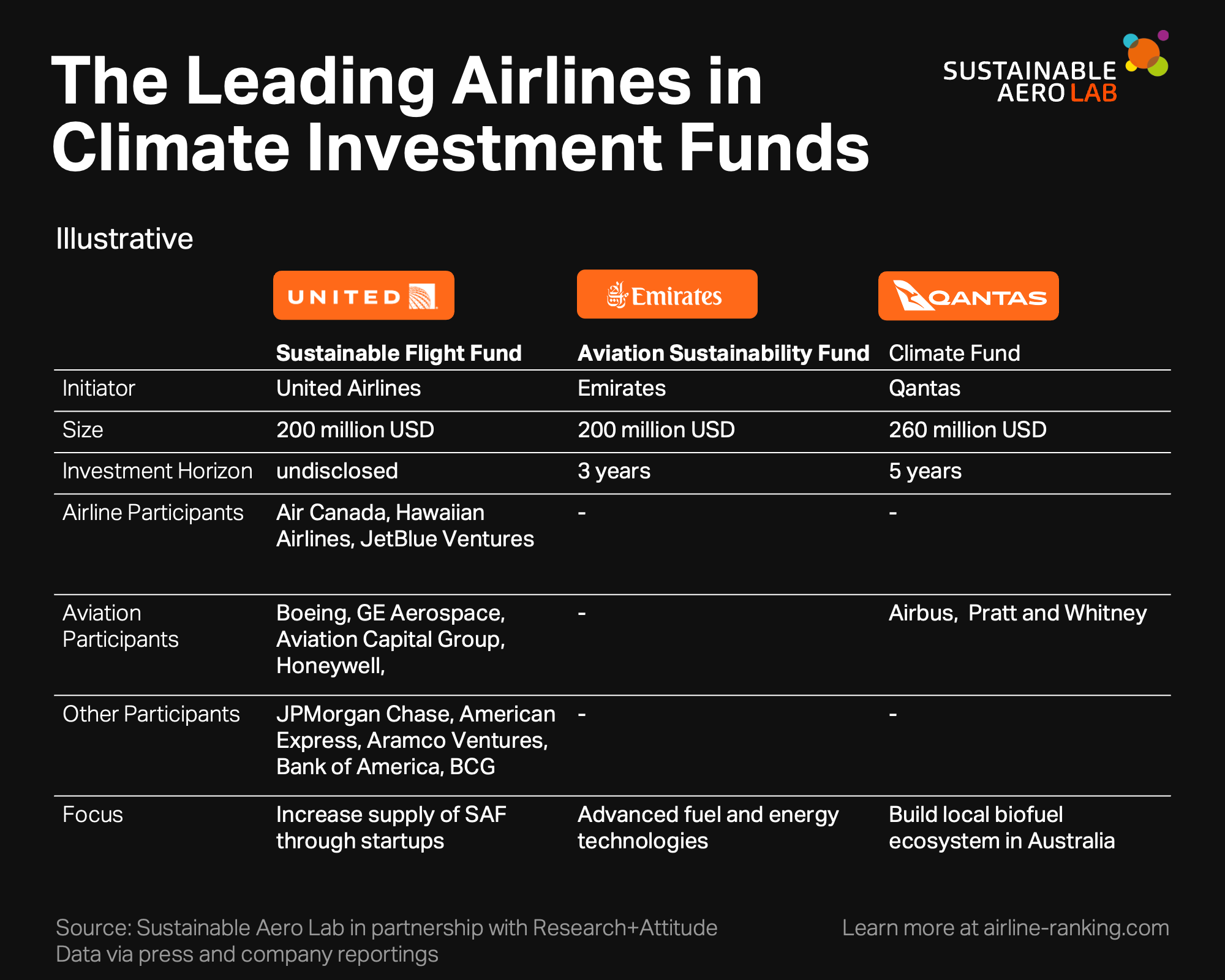

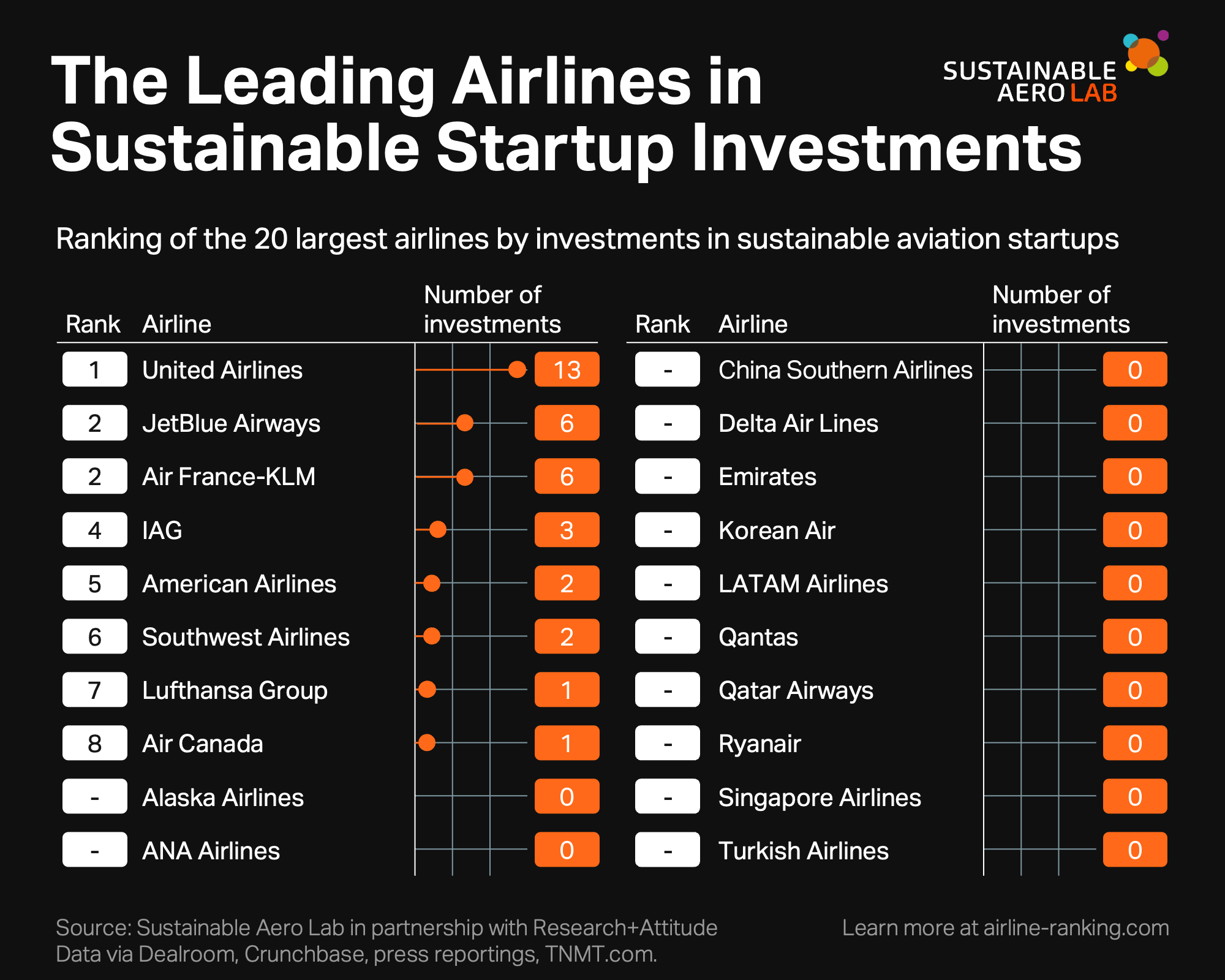

- United Airlines tops the ranking with a 62% Net-Zero Rate, demonstrating the highest level of commitment among the world's 20 largest airlines. This leadership is particularly evident in its industry-leading efforts to fund the future of sustainable aviation. United excels through the most substantial SAF offtake agreements, a dedicated Climate Fund worth $200 million USD, and the most investments in startups developing technologies for a more sustainable aviation future.

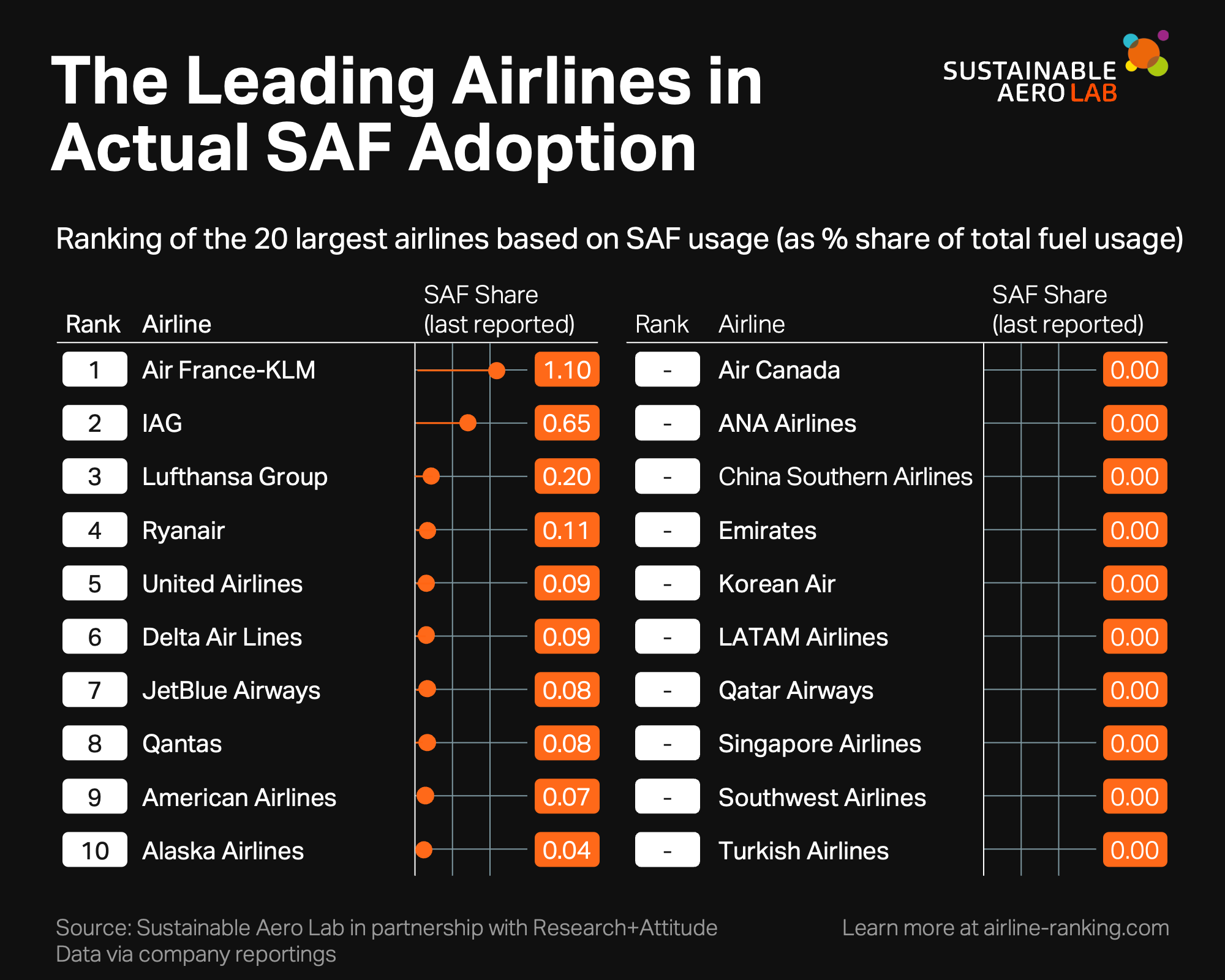

- Air France-KLM follows in second place, leading the European airline industry. This ranking is due to Air France-KLM boasting the highest share of Sustainable Aviation Fuel (SAF) in its current jet fuel mix. Notably, Air France-KLM is the only major airline in the world already using more than 1% SAF in its annual jet fuel consumption, also a testament to France’s stringent SAF mandates.

From our analysis, several additional key insights emerge that highlight the current state and challenges of the airline industry's net-zero commitments:

- Lack of Comprehensive Strategies: The Net-Zero Airline Ranking shows that no airline is heavily committed across all five net-zero metrics (more on the five key metrics below), indicating a lack of truly comprehensive net-zero commitment strategies. This highlights the need for airlines to develop more integrated approaches to sustainability.

- Marketing vs. Reality: Despite many airlines regularly praising their net-zero sustainability efforts, the disappointing results of our Net-Zero Airline Ranking reveal a significant gap between rhetoric and reality. This disparity suggests that aviation's current CO2 net-zero outlook is more of an illusion than a viable reality, as detailed in our Net-Zero Emissions Primer.

- Threat to Industry: Today’s lack of net-zero commitments across the airline industry poses a severe threat, not only to the climate but also to aviation's social license to operate in the coming decades. The climate crisis will only intensify, and industries failing to adapt will find it increasingly challenging to continue business as usual.

These takeaways underscore the urgent need for more genuine and comprehensive net-zero strategies within the airline industry. It is crucial for airlines to move beyond superficial PR commitments and invest in substantial, impactful changes to secure a sustainable future for aviation.

On a positive note, the Net-Zero Airline Ranking shows that airlines can significantly improve their position with relatively small efforts. Given the current low level of net-zero commitment across the industry, even modest investments in sustainability can lead to noticeable improvements, at least when measured against one’s airline peers.

This should serve as a powerful motivator for airlines to take meaningful steps, no matter how small, towards a more sustainable future.

For Context: Five Metrics for More Clarity

Our ranking is based on five core metrics, detailed in the table below. For a comprehensive explanation of our chosen metrics, please refer to our methodology primer.

Crucially, all five dimensions share a common trait: they require substantial monetary investments. This financial commitment sets them apart from typical marketing initiatives, which have become so prevalent in the airline industry that even authorities like the European Commission have taken action against 20 airlines for misleading greenwashing practices.

Our inaugural Q2 2024 ranking acknowledges the leading airlines in the following categories.

We plan to expand this basket of metrics in the months to come.

- Modern Fleets: The airlines with the most modern fleets.

- SAF Adoption: The airlines with the most extensive adoption of Sustainable Aviation Fuel (SAF) today.

- Future SAF Access: The airlines most committed to future SAF supply through offtake agreements.

- Climate Investment Funds: Those airlines that have set up dedicated climate investment funds to support cutting-edge net-zero technologies.

- Startup Investments: Those airlines most active in investing in emerging startups driving sustainable aviation technologies and approaches.

The scoring system works as follows:

- The Net-Zero Airline Ranking scores each of the world's 20 largest airlines on a scale from 0 to 1 for these five key metrics.

- The highest-performing airline per metric receives a score of 1, the lowest a score of 0, and all other airlines are scored proportionally based on their deviation from these values. For the metric “Climate Fund,” airlines can only receive a score of 1 (yes, climate fund set up), 0.5 (those participating in a climate fund set up by another airline), or 0 (no climate fund involvement).

- The overall Net-Zero Commitment Score for each airline is determined by aggregating the five individual scores, with all five variables weighted equally.

For more context, please refer to our full methodology page.

The Path Forward

A major challenge within the airline industry is the absence of real incentives for airlines to commit to accountable net-zero strategies. Without a clear means to measure and identify those genuinely dedicated to a sustainable future, managing airlines’ emission outputs is nearly impossible.

The Net-Zero Airline Ranking aims to play an effective role in addressing this issue.

We strive to bring greater transparency to the airline CO2 debate, preserving the magic of flying while promoting sustainability.

Ultimately, we hope the airline industry will voluntarily start to transparently report on meaningful net-zero commitment measures. This is barely the case today, where even basic sustainability figures, such as current SAF fuel consumption shares, are hidden in airlines’ annual company reports.

The banking industry might act as a role model in this context. More and more banks commit to official disclosure agreements on their clean energy financing ratios or the proportions of their low-carbon to fossil-fuel financing activity. This transparency helps investors gauge progress and paves the way for other banks to follow.