Methodology: How to Measure Airlines’ Net-Zero Commitment

Evaluating the world’s largest airlines and their sustainability efforts using five key metrics.

The Net-Zero Airline Ranking assesses the commitment of the world’s 20 largest airline groups (based on total revenue) to achieving a net-zero aviation future. It represents the first publicly shared, quantifiable effort to hold the airline industry accountable for significant sustainability investments.

In this article, we thoroughly explain the methodology of the Net-Zero Airline Ranking and our plans to fine-tune it going forward. Our main objective is to motivate the airline industry to take more real action to address its current net-zero illusions.

We welcome your support and feedback on expanding the ranking’s scope and granularity.

Please feel free to get in touch with us via info@sustainable.aero

This focus ensures that our ranking highlights genuine actions over superficial promises. Below, we delve into each metric and its relevance in driving the industry toward a more sustainable future. But first, some important context upfront.

A New Approach to Measure Climate Commitment

We have chosen to bypass the most common metrics for measuring airlines’ sustainability performance, such as CO2 emissions per passenger-kilometer (or revenue per passenger-kilometer).

This metric, which calculates the amount of CO2 emitted to transport one passenger over one kilometer, is widely used. It accounts for both the emissions from fuel burn and the passenger load factor by dividing an airline's total CO2 emissions by the total revenue passenger-kilometers flown. This allows for comparing the relative emissions efficiency between different airlines.

However, we have several reasons for ignoring this and other closely related per-unit emissions metrics:

- Contextual Misleading: These metrics can be easily misleading if not considered within the proper context. For example, airlines focused on long-haul flights tend to have lower CO2 emissions per passenger-km compared to short-haul operators because a larger portion of a long-haul flight is spent in the more fuel-efficient cruise phase. Conversely, short-haul flights have proportionally more fuel-intensive take-offs and landings. Similarly, low-cost carriers generally have higher load factors (percentage of seats filled) compared to full-service airlines, giving them an advantage in terms of emissions per passenger-km, as the same emissions are divided across more passengers.

- Focus on Current Efficiency: Even more importantly, emissions per passenger-kilometer are entirely focused on today’s state of operational efficiency and do not consider an airline’s broader commitment to reducing emissions in the future. This metric overlooks significant factors such as investments in innovative technologies and the adoption of Sustainable Aviation Fuel (SAF), which are much more crucial for turning around the aviation industry’s emissions outlook.

Five Alternative Metrics for More Clarity

Finding metrics that truly represent real commitment was no easy exercise. Airlines usually don’t report on budgets and initiatives aimed at more sustainable operations. Therefore, finding proxies that do so has involved extensive research and analysis.

The basket of metrics we have developed is not without its flaws, but it offers a more comprehensive understanding of airlines’ net-zero commitments.

Crucially, all five dimensions share a common trait: they require substantial monetary investments. This financial commitment sets them apart from typical greenwashing initiatives, which have become so prevalent in the airline industry that even authorities like the European Commission have taken action against 20 airlines for misleading greenwashing practices.

We hope to expand and fine-tune the methodology over the months to come. We welcome input and constructive feedback from the industry on how to best achieve this.

Our inaugural Q2 2024 ranking acknowledges the leading airlines in the following categories.

- Modern Fleets: The airlines with the most modern fleets.

- SAF Adoption: The airlines with the most extensive adoption of Sustainable Aviation Fuel (SAF) today.

- Future SAF Access: The airlines most committed to future SAF supply through offtake agreements.

- Climate Investment Fund: Those airlines that have set up dedicated climate investment funds to support cutting-edge net-zero technologies.

- Startup Investments: Those airlines most active in investing in emerging startups driving sustainable aviation technologies and approaches.

The scoring system works like this:

- The Net-Zero Airline Ranking scores each of the world's 20 largest airlines on a scale from 0 to 1 for these five key metrics.

- The highest-performing airline per metric receives a score of 1, the lowest a score of 0, with other airlines scored proportionally based on their deviation from these values. For the metric “Climate Investment Fund,” airlines can only receive the score of 1 (yes, climate fund set up), 0.5 (those participating in a climate fund set up by another airline), and 0 (no climate fund involvement).

- The overall Net-Zero Commitment Score for each airline is determined by aggregating the five individual scores, with all five variables weighted equally.

Below, we will delve deeper into each metric one by one and its significance in driving the industry toward a sustainable future.

Metric #1: Average Fleet Age

When assessing an airline's true commitment to reducing its carbon footprint, one crucial metric is the average age of its fleet. This figure serves as an indirect reflection of how modern and efficient an airline's fleet is. The basic rule of thumb is: the younger the fleet, the lower its CO2 emissions. This correlation largely stems from technological advancements. Each new generation of commercial aircraft is usually 15% to 20% more fuel-efficient than its predecessor, thanks to ongoing advancements in aerodynamics, lighter aircraft materials, and engine efficiency.

However, it is important to understand that “average fleet age” is only a rough proxy for assessing the level of CO2 efficiency of an airline's fleet. Ideally, a more accurate assessment would involve examining each aircraft type individually, but this level of detailed analysis is not publicly available. Therefore, we have chosen “average fleet age” as a practical indicator while acknowledging that it should be taken with a grain of salt.

Another limitation of fleet age that needs to be considered is that legacy carriers tend to have much older aircraft fleets. Their fleet sizes are much bigger, and hence, they are much harder to rejuvenate than airlines with smaller fleets. Hence, the average fleet age slightly discriminates against bigger legacy carriers.

As of today, average fleet age comparisons are rarely spotlighted in analyst reports. While most airlines officially report their fleet age in annual reports, making it relatively easy to research, it remains an underrepresented metric in public sustainability debates. There isn't a single comprehensive public source that consistently outlines the average fleet age for the entire airline industry.

Here is what the top-20 airline ranking on fleet age looks like that went into our initial Q2 2024 Net-Zero Airline Ranking:

Metric #2: Today’s SAF Leaders

Sustainable Aviation Fuel (SAF) is widely considered the most impactful lever for the aviation industry to limit its carbon footprint in the near future. However, SAF is also heavily exploited for marketing purposes by airlines, with many airlines promoting "SAF-powered flights," despite marginal SAF contributions and these flights often being one-off exceptions.

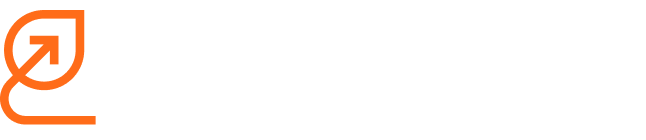

To clarify which airlines are truly leading the way in SAF usage today, not just in words but in action, we researched and ranked the 20 largest commercial airlines based on their actual SAF usage in 2023. We present the SAF usage as a share of an airline's annual total jet fuel consumption to showcase how airlines score against each other considering their size and total fuel consumption.

We limited the list to the top 10 airlines because 10 airlines have not yet shared any SAF intake usage numbers, leading us to assume they are not using SAF in measurable quantities when compared to their annual jet fuel usage.

Here is the top-20 airline ranking based on SAF usage and how it was incorporated in our inaugural Q2 2024 Net-Zero Airline Ranking.

Important Side Note: Even Air France-KLM, as the best-performing airline, currently sources only slightly more than 1% of its total fuel consumption from SAF. This fact underscores the vast scope of progress still required in the industry to achieve significant sustainability milestones.

Metric #3: Tomorrow’s SAF Leaders

When evaluating the airline industry’s leaders in SAF adoption, it is crucial not only to highlight those currently using the most SAF but also to recognize those preparing for a SAF future. The main reason? SAF supply is extremely limited–see our deep dive–currently below 0.2% of total jet fuel demand. The industry urgently needs to incentivize the rapid expansion of SAF supply. This is where SAF Offtake Agreements come into play. Such agreements are contractual commitments airlines make to purchase specified volumes of SAF from producers at a future date.

These agreements are crucial for several reasons:

- To producers, they signal that there is a market for SAF, encouraging investment in production capacity.

- For airlines, these agreements secure the future supply of SAF, aiding in planning and meeting jet fuel needs.

- By guaranteeing a market, these agreements spur innovation and potentially lower costs through economies of scale.

The rule of thumb: The more SAF volume airlines order through these agreements, the more net-zero committed they are.

The International Civil Aviation Organization (ICAO) recognizes the importance of SAF offtake agreements, which is why it has developed a public tracker that monitors all publicly announced offtake deals between airlines and fuel producers. Leveraging the data from the ICAO tracker, we've researched the list of the 20 largest airline groups, and their respective volumes of SAF agreed upon in these offtake agreements over the past ten years.

For simplicity reasons, we did not rank SAF offtake leaders based on quantities they committed to as a share of their annual fuel consumption but based on absolute SAF offtake quantities. This approach was also chosen because the nascent SAF ecosystem highly depends on as much SAF demand as possible to initiate SAF expansion. Therefore, those ordering the most SAF volumes are doing the industry the greatest favor.

Despite the relevance of SAF offtake agreements, using these volumes as a metric to gauge net-zero progress is not without its challenges. These agreements come with caveats that need careful consideration.

- It's crucial to understand that these agreements usually hinge on the construction of SAF production facilities and the expectation of competitive pricing. Airlines, as future SAF purchasers, typically secure clauses that protect them against spikes in SAF prices. This shifts the burden of realizing these ambitious SAF projects almost entirely onto fuel producers, which must navigate the financial viability of their operations without guaranteed profitability.

- The demand for competitively priced SAF has led airlines to adopt a more aggressive stance in negotiating offtake agreements. This heightened scrutiny over SAF pricing has likely contributed to a noticeable decrease in new SAF offtake volume agreements in 2023, especially outside the United States. This trend is alarming, given the aviation industry's urgent need to scale up SAF production globally to overcome the supply crunch.

Metric #4: Climate Fund Leaders

The fourth dimension of our Net-Zero Airline Ranking focuses on airlines' dedication to substantial investments in groundbreaking technologies and greenfield projects through climate-focused investment funds. Achieving net zero in aviation requires radical innovation in several areas:

- Expanding SAF Exploration and Green-Energy Production: Airlines must fund and support the energy industry's efforts in scaling next-gen energy supply through direct investments in greenfield projects.

- Advanced Airframe Designs: Moving beyond traditional "tube and wing" aircraft designs to explore advanced concepts like blended wing bodies, despite the technical challenges they face, especially in pressurization.

- Novel Propulsion Systems: Developing and investing in new propulsion systems, such as battery-electric and hydrogen technologies.

Experts estimate that achieving these innovations will require an investment of approximately $5 trillion USD by 2050, translating to an annual innovation budget of $175 billion USD. This figure starkly contrasts with the aviation industry’s current total R&D spending of about $23 billion USD annually.

Given this trillion-dollar investment requirement, no single entity can bear the financial burden alone. The entire aviation ecosystem, including airlines, must contribute. Airlines, while not manufacturers or fuel producers, play a crucial role in funding and backing promising new aircraft and energy technologies. They are responsible for operating aircraft sustainably and transporting passengers with minimal environmental impact.

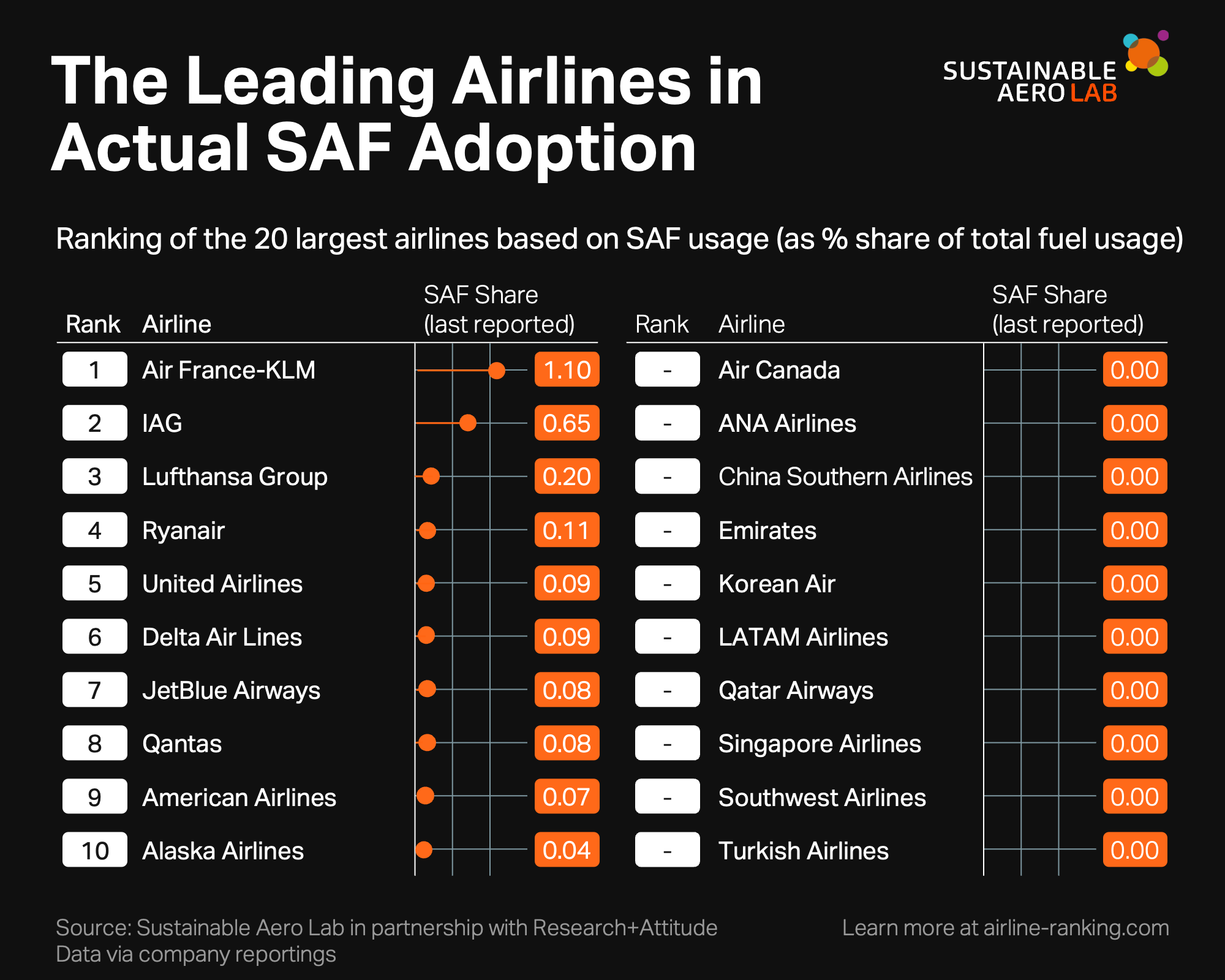

Therefore, our fourth metric evaluates which airlines are setting up dedicated climate investment funds to support these vital innovations. Despite the importance, only three major airlines have established standalone climate-focused investment funds to date.

- In our inaugural Q2 2024 Net-Zero Airline Ranking, United, Emirates, and Qantas were awarded the highest score of 1 for their leadership in setting up such dedicated climate funds.

- JetBlue and Air Canada scored 0.5 for their participation in United’s fund, while the remaining 15 airlines received a score of 0 due to their lack of involvement in such climate-focused investments.

By highlighting these commitments, we aim to encourage more airlines to establish and participate in climate funds, driving the industry towards a sustainable future through significant financial investment in radical innovation.

Metric #5: Leaders in Sustainable Startup Investments

The fifth dimension of our Net-Zero Airline Ranking measures airlines' direct financial support for new technologies through investments in emerging startups. Engaging with startups is a powerful way to drive innovation and change, yet the airline industry has largely overlooked this approach. According to Lufthansa Innovation Hub’s TNMT, only 8% of airlines worldwide have ever invested in startups. This lack of engagement is a missed opportunity, particularly in the context of sustainability.

Corporate startup investments, typically executed through dedicated Corporate Venture Capital arms, are a common strategy in many industries. Such engagements provide valuable insights into new approaches and allow companies to participate in innovative solutions that address critical industry pain points. This is especially important for the aviation industry, which must overcome its sustainability challenges.

To identify which airlines are most committed to investing in startups, particularly those focused on sustainable aviation technologies, we conducted extensive research.

- We examined all publicly reported airline startup investments, utilizing platforms and deal lists from TNMT, Dealroom, Skift, PhocusWire, and more.

- We then filtered these investments to focus on startups working on novel technologies for a more sustainable aviation future.

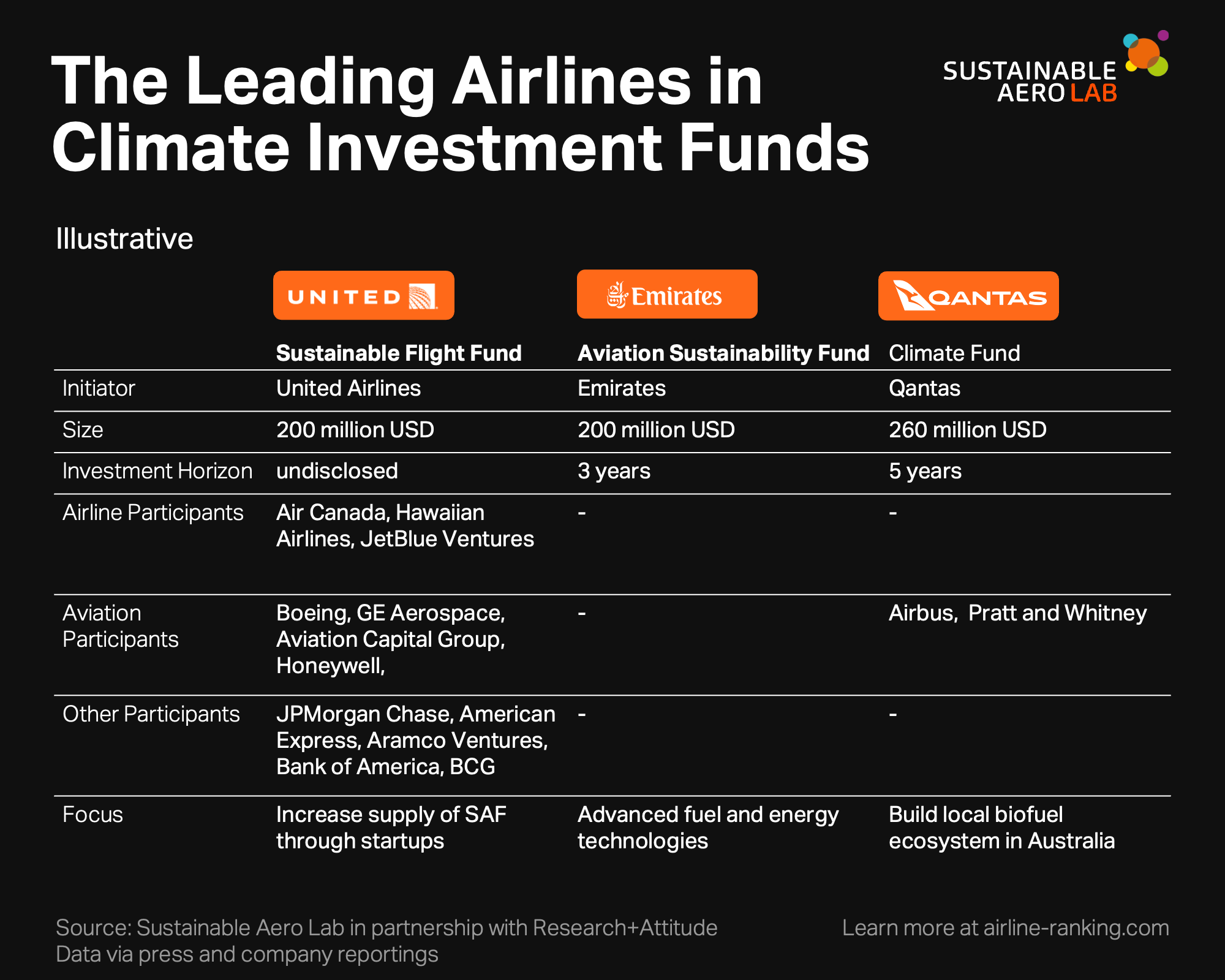

According to our research for our Q2 2024 Net-Zero Airline Ranking, only eight airlines from our top-20 airline sample have invested in Sustainable Aviation startups thus far.

- United Airlines has invested in 13 Sustainable Aviation startups across various categories, including SAF expansion and revolutionary electric and hydrogen propulsion systems. Examples include Electric Hydrogen, which specializes in the development and deployment of electrolyzer plants for producing green hydrogen, and Dimensional Energy, which converts captured carbon dioxide into ingredients for the Fischer-Tropsch process leading to SAF.

- Besides United, JetBlue, through its dedicated VC arm, JetBlue Ventures, is noteworthy. It has invested in six Sustainable Aviation startups thus far, including Aether Fuels and Air Company (both SAF production), Pulsora (an enterprise sustainability management platform), and Avnos (carbon capture).

- Air France-KLM shares rank #2. It also has six sustainable startup investments (including investments executed via its SHIFT Invest fund). Recent deals include C1 Connections (wind turbines) and Volytica Diagnostics (battery analytics), showcasing how an airline can look beyond the immediate aviation industry to tap into the energy sector for net-zero initiatives.

The remaining airlines have made only a few one-off investments, but this is still better than none, considering that 98% of IATA-registered commercial airlines globally have not made any such investment bets.

Important Disclaimer: Startup investments are powerful indicators of any company’s commitment to innovation, especially within traditional corporations like most legacy carriers. Establishing dedicated venture capital arms is usually a major undertaking, requiring significant internal effort and determination. Therefore, all airlines that have committed to startup investments in Sustainable Aviation deserve recognition for their efforts, even though there is no guarantee that these bets will yield financial or technological returns.

The quality of these investments is just as important as their quantity. Selecting the right startups to invest in requires careful consideration and expertise. A comprehensive analysis would necessitate detailed due diligence on each investment listed above. However, this exceeds the current scope of the Net-Zero Airline Ranking, which aims to highlight and commend airlines' commitment. For this purpose, overall activity, measured by the number of investments, is a more practical and objective criterion. Therefore, in our inaugural Q2 2024 Net-Zero Airline Ranking, we score airlines based on the total number of sustainable aviation startup investments, emphasizing the importance of actively supporting innovation to drive the industry towards a sustainable future.

Join the Net-Zero Conversation

We hope that by showcasing the methodology of our Net-Zero Airline Ranking in such detail, we can clearly communicate our intention to help and inspire the airline industry to consider net-zero commitments from a broader perspective.

We invite you to join the conversation. Share your experiences and opinions on these metrics as measures of innovation commitment.

What other metrics do you think are crucial for evaluating airline sustainability commitment?

Let’s work together to ensure that the aviation sector not only talks the talk but also walks the walk toward its net-zero goals.